Our Blog

Rent Your Property Tax-Free

Most income you receive is taxable income that is reported to the federal and state tax authorities. However, renting out your home or vacation property on a short-term basis can be done tax-free if you follow the rules. The rule: If you receive rental income for less...

A Time to Organize

Diverse tax reporting makes this year a challenge The time to organize your tax records is now. Informational tax information is hitting your regular and digital mailboxes from now until late March. To make matters worse, this year there are economic recovery...

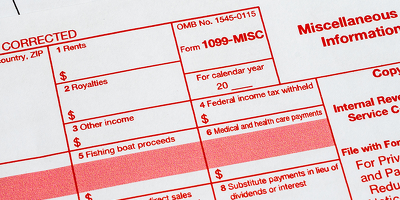

What? This Form 1099 is Wrong!

What to do to fix this thorny problem It is late February and you realize the Form 1099 you received is in error. In fact, it overstates your income by several thousand dollars. What should you do? Gather your facts. Put yourself in the shoes of the vendor, bank or...

IRS to Send Recap of Economic Impact and Child Tax Payments

The IRS recently announced it will be sending out a recap of payments sent to taxpayers for the multple rounds of Economic Impact Payments and Advanced Child Tax Payments. Here is what you need to know. Economic Impact Payments During 2021, the IRS issued millions of...

Reminder: Fourth Quarter Estimated Taxes Now Due

Now is the time to make your estimated tax payment If you have not already done so, now is the time to review your tax situation and make an estimated quarterly tax payment using Form 1040-ES. The 2021 4th quarter due date is now here. Due date: Tuesday, January 18,...

2022 Mileage Rates are Here!

New mileage rates announced by the IRS Mileage rates for travel are now set for 2022. The standard business mileage rate increases by 2.5 cents to 58.5 cents per mile. The medical and moving mileage rates also increases by 2 cents to 18 cents per mile. Charitable...

Have Questions About the New Tax Laws?

Tina Minton is available to share with your business team or service organization. Her 30-minute presentation is ideal for sales meeting, lunch and learn, or other events. Please contact Brea at 757-546-2870 to schedule.

Phone

Opening Hours

Mon-Fri: 8:30am – 5:00pm

Summer Only: 8:30 am – 1:30 pm